How R&D Tax Credits are changing from April 2023

Posted on 17 July 2023

In the Autumn Statement 2022, and subsequently in the Spring Budget 2023, Chancellor Jeremy Hunt announced changes to R&D Tax Credits for UK businesses, affecting both SMEs and large organisations from April 2023 and April 2024. The changes to R&D Tax Credits reflect a shift in strategy from the Treasury for investment in UK innovation.

In brief, the rates will be rebalanced so that businesses claiming under the R&D SME scheme will receive a lower rate of tax relief, while those claiming R&D Expenditure Credit (RDEC) will secure more generous rates. The R&D changes also emphasise a strong drive from the government to tackle abuse and improve compliance.

How are rates of reliefs changing for the SME R&D scheme from April 2023?

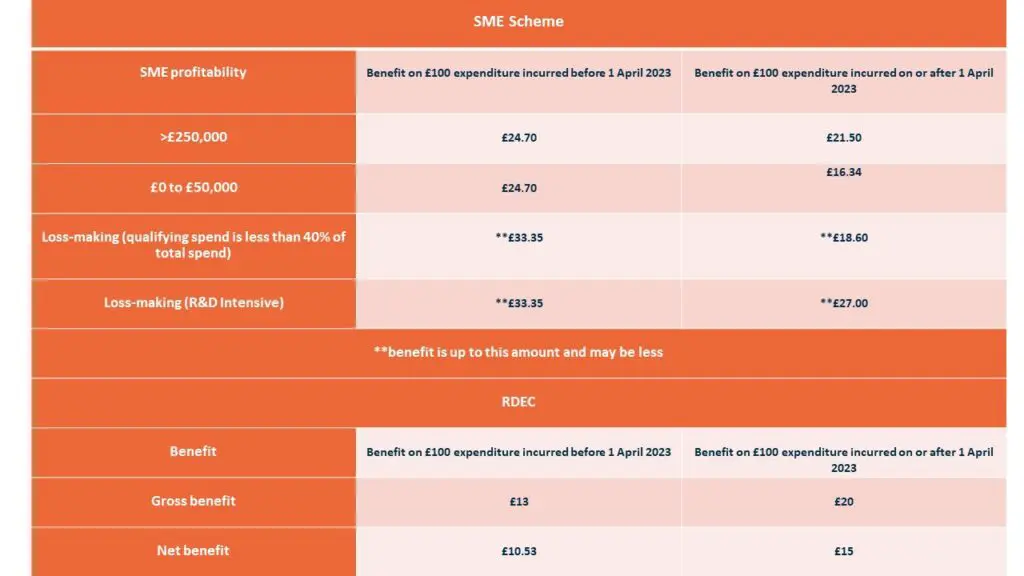

For expenditure from 1st April 2023, the additional deduction for SMEs will decrease from 130% to 86% and the SME credit rate will reduce from 14.5% to 10%, except for loss-making SMEs that are R&D intensive. If an SME’s qualifying expenditure is at least 40% of their total expenditure, they will be classed as R&D intensive and able to claim a higher payable credit rate of 14.5% for qualifying R&D expenditure.

How are rates of reliefs changing for RDEC from April 2023?

For expenditure from 1st April 2023, the Research and Development Expenditure Credit (RDEC) rate will increase from 13% to 20%.

Example Changes to R&D Tax Credits from April 2023

Is the SME R&D scheme still worth it?

Absolutely! The UK Government is still committed to supporting research-intensive SMEs, and the tax relief available can provide vital support. While the relief will be less generous, it’s important to view the changes coming in 2023 as a whole. For example, from April 2023, Corporation Tax will increase to 25% for companies with over £250,000 in profits, which would result in just a £3.20 difference in R&D Tax Credits for every £100 spent (see table above, Example Changes to R&D Tax Credits from April 2023).

Even for less profitable SMEs, or SMEs who are making a loss, the cash injection provided by R&D Tax Credits can make a big difference – especially for R&D intensive SMEs! You can speak to one of our expert consultants to find out how the coming R&D changes will affect your Tax Credits claim.

Will the changes affect my upcoming R&D Tax Credits claim for my current R&D activity?

Upcoming changes only affect expenditure for Accounting Periods beginning on or after 1st April 2023. This means that SMEs undertaking innovative R&D can still take advantage of the government’s more generous relief rates up until accounting periods beginning on or after 1st April 2023. It is important to ensure that your business doesn’t miss out on the tax relief available to you.

Why are the R&D relief rates changing from April 2023?

The UK Government has said that the R&D Tax Credits are being reformed “to ensure public money is spent effectively and best supports innovation”. In other words, the reforms are meant to tackle wastage and increase lucrative R&D activity, leading to private investment and economic growth.

The changes to the SME R&D scheme come in the face of increased scrutiny against claims due to reports of fraudulent tax relief claims. HMRC’s Annual Report and Accounts for the financial year 2021 to 2022 estimate that under the SMEs scheme there was a 7.3% level of error and fraud compared to just 1.1% for the RDEC scheme, which totals £469 million (£430 million from the SME R&D scheme and £39 million from the RDEC scheme).

More importantly, the RDEC scheme is seen by the Treasury as more effective at driving ground-breaking innovation, building important assets within UK-based companies, and delivering better value for the British tax payer. The most recent studies from HMRC, published in 2019 and 2020, show that for every £1 of support, the RDEC incentivised £2.40 – £2.70 of additional private R&D expenditure, and the SME scheme incentivised £0.60 – £1.28.

As well as boosting a scheme that the government sees as successful, the relief rates have been increased because RDEC needed reform to make it more competitive internationally.

What else is changing for R&D Tax Credits for Accounting Periods beginning on or after 1st April 2023

Several other important changes to R&D Tax Credits were announced in last year’s Autumn Budget. Most measures are designed to improve protection against fraud and errors in R&D claims. The new measures state that:

1) Claims submitted digitally

All companies will have to submit their R&D claim online. Mandating digital submission for all R&D-related expenses makes it easier for HMRC to review information and conduct risk assessments.

2) Claims must include additional information

All claims must include additional information to support claims, such as a breakdown of the types of R&D expenditure. Again, this measure helps HMRC conduct risk assessments.

3) Claims must be supported by a named officer of the company

A higher level of scrutiny is being placed on precisely who is submitting the claims, meaning that all claims will need to be supported by a named officer of the company, protecting against unauthorised claims being taken in the business’s name.

4) Claims must include details of any associated agents

Each R&D claim will need to include details of any agents associated with the submission. Requiring details of any agent associated with the claim will allow HMRC to spot the involvement of agents with a track record of facilitating spurious claims.

5) Claimants must submit a pre-notification of their claim, if companies are new claimants or have not claimed in the previous 3 accounting periods

New rules require first-time relief-claiming businesses (or businesses who have not claimed in the last three financial periods) to submit a pre-notification of their claim to HMRC online. This gives HMRC the opportunity to take proactive steps in educating companies on valid R&D processes and also provides extra safeguards against reliefs being illegally claimed. Find out more about pre-notification by reading our white paper R&D Tax Relief Is Changing: Is your business ready for Pre-Notification?.

6) There are expanded categories of qualifying expenditure

Qualifying expenditure is also being reformed to include licence payments for datasets and data analytics and cloud computing costs.

When are restrictions on claiming relief on overseas R&D expenditure coming into effect?

From 1 April 2024 the government is introducing restrictions on some expenditure for overseas subcontract and Externally Provided Workers (EPWs) not paid through UK payroll. The change was originally meant to come into effect from April 2023, however HMRC is delaying the implementation of overseas expenditure restrictions by one year.

You can find out more about these restrictions by reading our blog on Overseas R&D expenditure.

How much money is the UK Government committing to R&D spending?

The government still sees R&D as essential to stimulating private sector investment and growing the UK economy. As such, they’re increasing public funding to £20 billion annually by 2024-25 (the largest increase in R&D funding ever).

What will happen to R&D Tax Credits in the future?

The Treasury have said that the R&D changes are a step towards a simplified, single RDEC-like scheme for all (including R&D intensive SMEs). They will publish draft legislation on a possible merged scheme for technical consultation in the summer. Leyton has worked with HMRC on past R&D consultations and as such we await more information on this R&D Tax Reliefs review with interest.

How can I ensure that my R&D Tax Credits claim is compliant?

HMRC’s new focus on improving compliance invariably means more ‘red tape’ for businesses to navigate and more personal culpability for company directors as claims must now be endorsed by a named senior officer. To avoid HMRC enquiries on your R&D claim, it is now imperative that business claiming or looking to claim R&D Tax Credits do so with an established, reputable provider to ensure maximum compliance through this period of change.

At Leyton, we’ve worked for twenty-five years, helping over 26,000 innovative companies put together robust and compliant claims. Our highly qualified tax experts and technical consultants can help your business navigate the R&D Tax Credit changes, ensuring you receive the maximum benefit that your business is eligible for in full compliance with HMRC.

Speak to a specialist today to find out how the coming changes will affect your R&D Tax Credits claim.